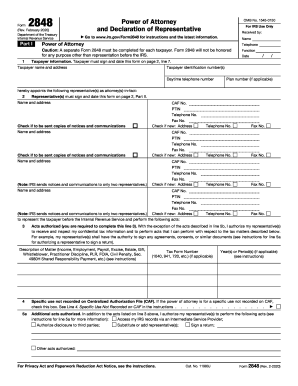

IRS 2848 2021-2026 free printable template

Instructions and Help about IRS 2848

How to edit IRS 2848

How to fill out IRS 2848

Latest updates to IRS 2848

All You Need to Know About IRS 2848

What is IRS 2848?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 2848

What should I do if I need to correct a mistake on my IRS 2848?

If you discover an error after submitting your IRS 2848, you can submit a corrected version. Ensure that the corrections are clearly indicated to avoid confusion. It’s advisable to attach a cover letter explaining the changes you made.

How can I verify the status of my submitted IRS 2848 form?

To verify the status of your IRS 2848 submission, you can contact the IRS directly or check your account online if you have set one up. It's important to have your submission details ready to help facilitate the inquiry.

What common errors should I look out for when filing IRS 2848?

Common errors on IRS 2848 include incorrect identification information, failure to sign the form, and not providing necessary additional documentation. Review your form carefully before submitting to minimize these risks.

Are there privacy and data security measures I should consider when submitting IRS 2848?

When submitting IRS 2848, ensure you're using secure methods if e-filing or mailing sensitive information. Check that your software is compliant with data protection regulations to safeguard personal information.

What happens if I receive an audit notice after submitting IRS 2848?

Receiving an audit notice after filing your IRS 2848 requires prompt attention. Prepare relevant documentation and responses to any specific inquiries outlined in the notice. It's often beneficial to consult a tax professional for assistance.

See what our users say